Stamp Duty holiday 2020

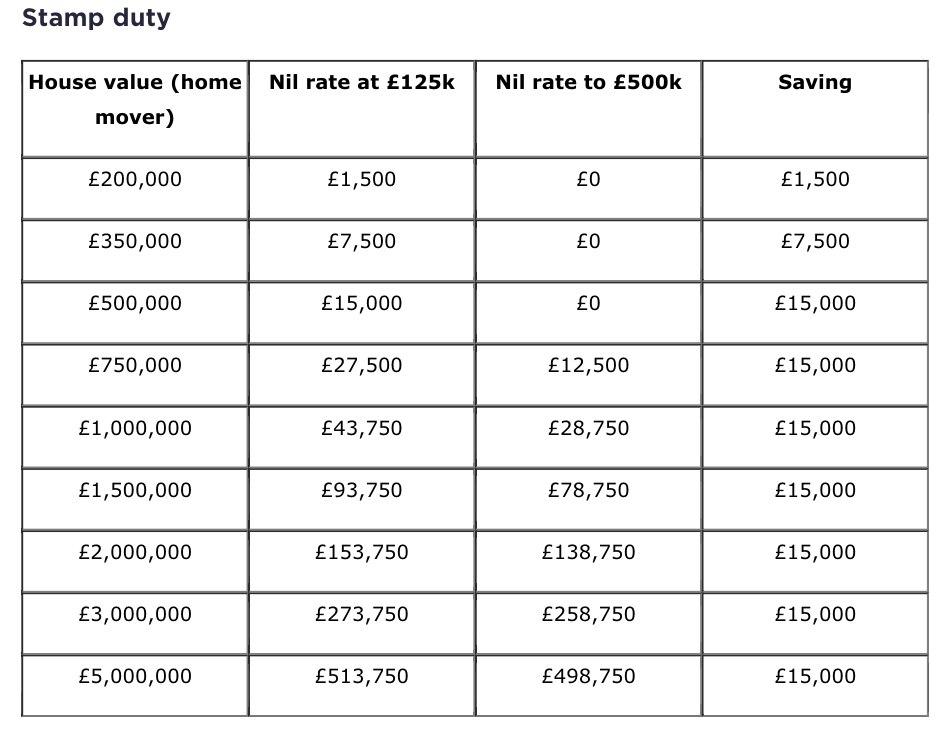

England and Northern Ireland announced an immediate cut in the rate of stamp duty (SDLT), by raising the threshold for the main rate of stamp duty to £500,000 until 31 March 2021.

This means anyone purchasing a main residence costing up to £500,000 between 8 July and 31 March will not pay any stamp duty, and more expensive properties will only be taxed on their value above that amount.

For example, a purchase at £300,000 it will represent a £5,000 saving (one already available to first time buyers), while for those buying a property for £500,000 or more it will result in a £15,000 reduction in transaction costs.

For those buying second homes or investment properties the 3% “additional homes surcharge” will still apply to the entirety of the purchase price.

This should act as a further spur to the market in England and make buyers that little bit more committed.