Help to buy

What is London Help to Buy? It is a government-backed scheme to help first-time property buyers (FTBs) buy new homes with just a 5% deposit required.

You can no longer apply for the Help To Buy: Equity Loan Scheme. Her support has been terminated.

The scheme allows borrowing 20% of the purchase price (or 40% for London homes) interest-free for 5 years. The rest is taken as a typical mortgage.

The Help-to-Buy scheme is available until the end of March 2023.

Who is eligible for Help to Buy London?

The Help-to-Buy scheme is for first-time property buyers in the UK only. You must be at least 18 years old and have no records of owning a property in the UK or abroad.

Moreover, the property should be newly built, meaning you can’t buy a second home or a buy-to-let property via Help-to-Buy.

The maximum purchase value for a Help-to-Buy home depends on the region. For instance, the upper limit for a new home in London should not exceed £600k.

How the Help-to-Buy scheme works?

The process of buying with Help-to-Buy goes as follows:

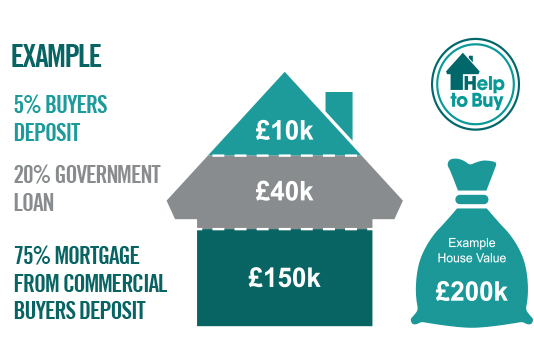

- Deposit. You raise a 5% deposit for an eligible new home.

- Equity loan. The government lends you 20% (or 40% in London) of a new home value, interest-free for 5 years.

- Mortgage. You borrow the rest 75% (or 55% for Londoners) from a mortgage lender on a typical repayment basis.

- From year 6, you will need to pay 1.75% of the equity loan, which will increase depending on the Consumer Price Index plus 2% (or 1% for those who took an equity loan before December 2019).

- This equity loan must be repaid over 25 years or earlier (if you sell your property).

How to pay back the interest-free loan with Help-to-Buy?

Once the interest-free period ends, you will repay the equity loan like this:

- Year 6: 1.75% of the loan

- Year 7+: 1.75% + Consumer Price Index (CPI) + 2% (or 1%)

For instance, year 7 means repaying 1.82% of the loan, while year 8 means 1.90%.

You will also have to pay a £1 monthly management fee. When you take out the equity loan, you agree to repay it in full, with interest and management fees included.

Ready to make your choice? Start with the most popular offers with the options that are right for you:

apartments with concierge service,

apartments with swimming pools,

apartment with balcony,

apartments with gyms,

apartment with roof terrace.