UK Housing Market Witnesses Sharpest Annual Decline in 14 Years

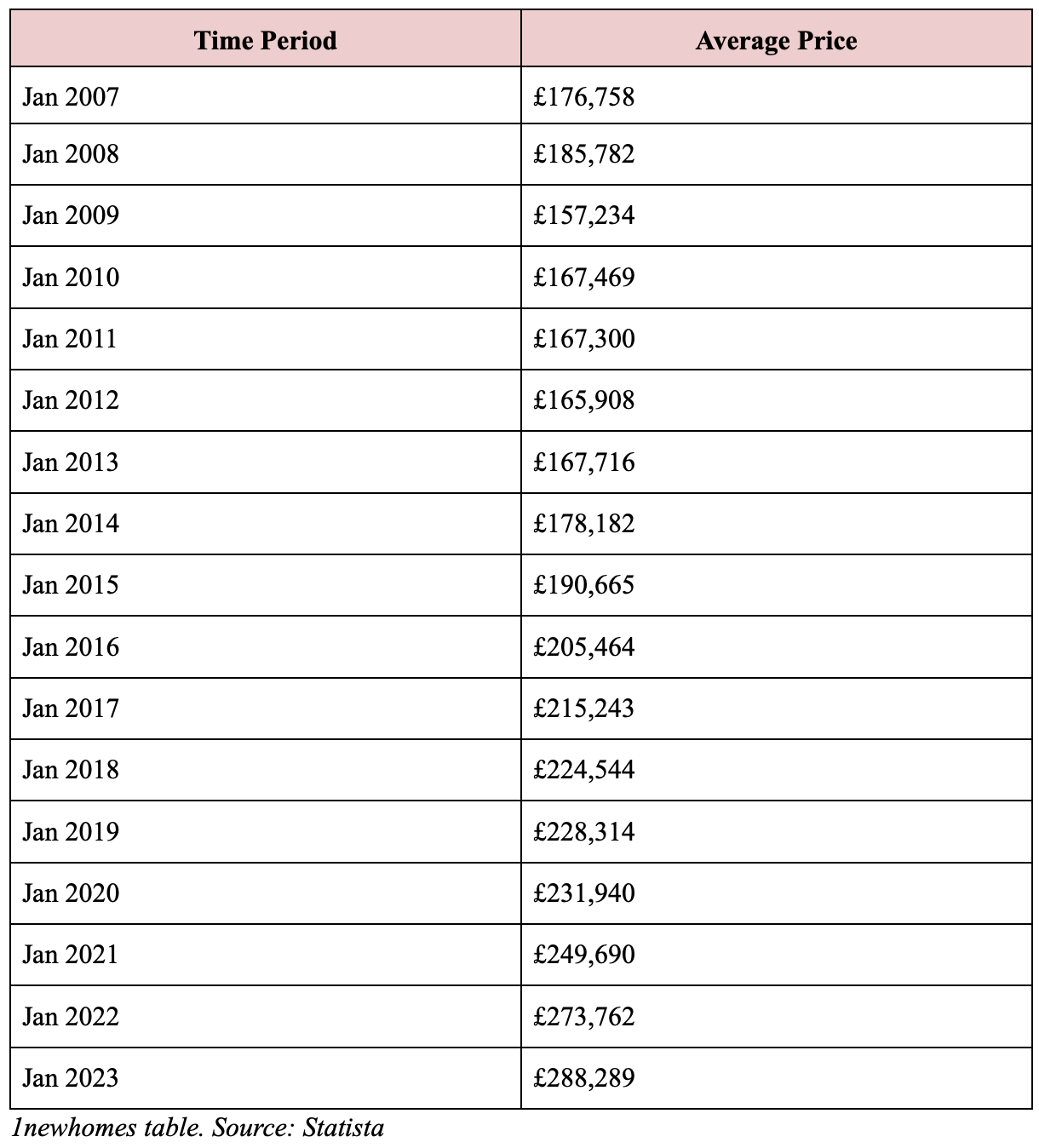

In July, the UK housing market experienced a significant downturn, with the median house cost registering its sharpest annual decline in 14 years, according to Nationwide's index. Property values saw a notable drop of 3.8 per cent on average over the past year, marking the weakest performance since July 2009.

During the same month, house expenses declined by 0.2 per cent month-on-month, resulting in an average price of £260,828.

The current median house cost is 4.5 per cent lower than the peak recorded in August 2022, indicating a challenging environment for prospective purchasers.

Although there has been some moderation in expectations, long-term interest rates, which influence mortgage costs, remain high, leading to limited affordability for potential homebuyers relying on debts.

As an illustration, let's consider a potential customer who earns a median wage and has the goal of buying a typical first-time buyer property. They plan to make a purchase with a 20 percent down payment. In this scenario, if we assume a mortgage rate of six percent, the monthly mortgage payments would amount to 43 percent of their take-home pay.

This figure has increased from 32% compared to a year ago and surpasses the long-run average of 29%. Moreover, the high deposit requirements, with a 10% deposit amounting to 55% of gross annual middle income, present an additional hurdle for potential clients.

Despite the challenges, many people remain optimistic that unemployment will stay low, and most existing borrowers should be able to handle the impact of higher borrowing costs. Currently, the Bank of England base rate equals five per cent, and further augmentations are predicted to combat inflation.

Several lenders responded to better-than-expected inflation news by reducing their fixed-rate loan pricing, resulting in the swap rates stabilization that determines the pricing of fixed-rate debts after a period of volatility.

According to Tom Bill, there is a projected 5% decrease in UK property prices for the year. Despite this prediction, it is believed that the demand for housing will demonstrate greater resilience than initially anticipated.

“While we expect UK estimates to fall by five per cent this year, demand should prove more resilient than supposed between now and the general election given the cushioning effect of wage growth, high levels of housing equity, lockdown savings, the availability of longer pledge terms, forbearance from lenders and the popularity of fixed-rate deals in recent years.”

Several factors contribute to this outlook:

- wage growth;

- robust housing equity levels;

- accumulated savings during lockdowns;

- extended mortgage terms;

- lender leniency;

- the widespread popularity of fixed-rate deals.

In response to the current housing market conditions, purchasers and sellers may need to adjust their strategies, with pricing flexibility and criteria adjustments becoming critical factors.