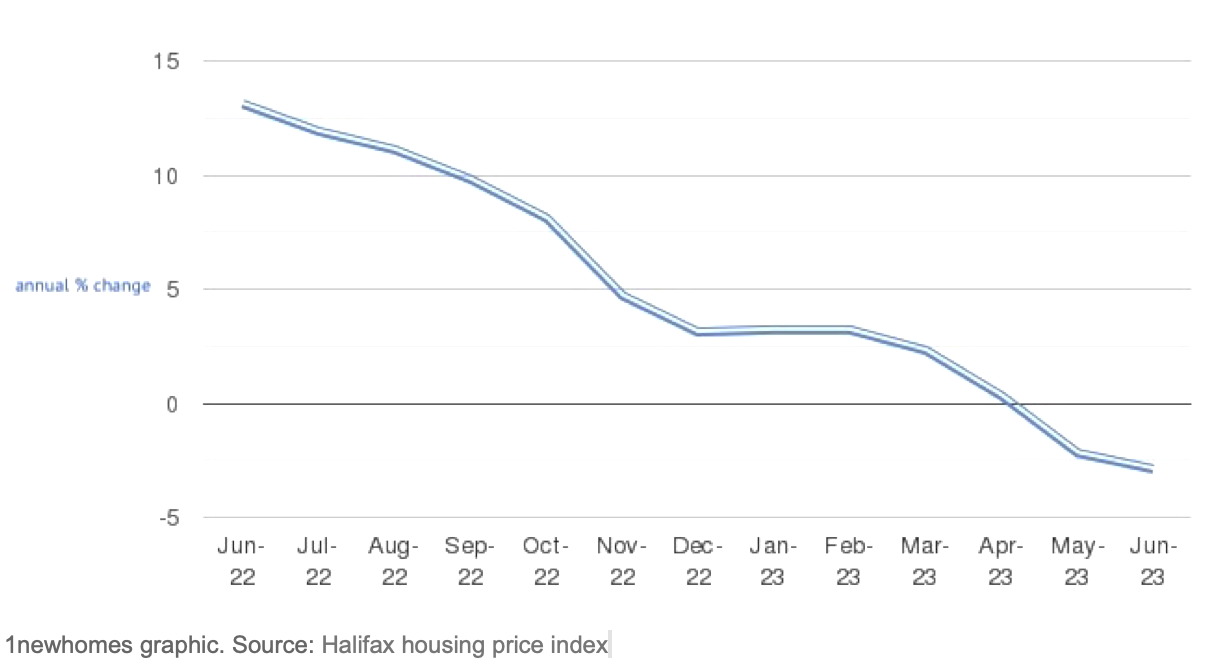

UK House Prices Experience Steepest Annual Decline Since 2009

The housing market in the UK is witnessing a significant downturn as mortgage rates maintain an upsurge, leading to the heaviest annual fall in property prices in 12 years.

In June, the average cost of a UK dwelling dropped by 2.6% compared to the previous year, marking the sharpest decrease since June 2011. This fall is a substantial rise from the 1.1% decrease recorded in May.

The housing market is sensitive to fluctuations in borrowing costs, and the recent surge in interest rates due to concerns about persistent inflation has led to increased funding expenses. As a result, affordability has been squeezed, causing potential buyers to reconsider their purchasing power and make more realistic offers. It, in turn, will likely dampen demand for housing.

The extent and duration of the payment decline in the housing market remain uncertain. However, market forecasts indicate that property loans rates will likely remain elevated for an extended period, given expectations of Bank Rates peaking at over 6%. This ongoing pressure on household finances will likely continue to exert downward pressure on real estate prices throughout the coming year.

While sales are still occurring, particularly among those who do not utilise mortgage financing, the process is taking longer. It often involves protracted renegotiations, resulting in modest cost reductions rather than significant drops.

According to the analysis, the average home cost in the UK now stands at £285,932, which is £8,060 lower than the peak observed in August last year.

It is also noted that despite experiencing three consecutive monthly drops in house bills, they have risen by 1.5% since the beginning of 2023 due to growth in the first quarter. It indicates a certain level of stability amid economic uncertainty.

The research also highlighted a notable shift in buyer demographics in recent months. The proportion of first-time purchasers has dropped from 71% in the same period last year to approximately 50% in the first half of this year. Additionally, the share of consumers aged 55 and above has increased from 10% to one-fifth of all sales.

Frequently Asked Questions

FAQ

Based on various regional and local factors, we anticipate a general decline in prices over the next three years. It is likely that prices will decrease by around 35 percent in nominal terms, starting from their peak in 2022 and continuing until 2025. This adjustment is expected as the UK undergoes its own financial recalibration in response to global economic events.

Based on our forecasts, it is anticipated that property prices in the UK will experience a 23% increase by 2020 and a substantial 97% increase by 2030. For instance, if an average-priced home currently costs £280,000, it is projected to reach approximately £344,000 in five years and surpass half a million pounds in fifteen years.