Your First Home: Making the Right Choice in London

If you are choosing your first or next home in a new development, 1newhomes has curated the most comprehensive database of new homes in London.

We assist with every aspect of home selection for first-time buyers.

Choosing the Location

As residents, you value your comfort and safety. With us, you will find answers to all crucial questions:

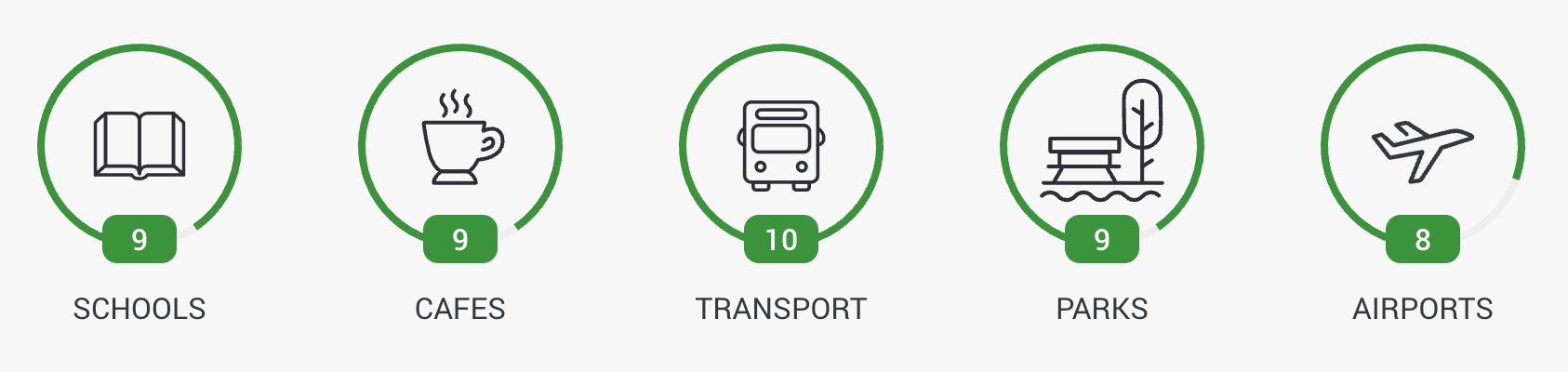

- Transport accessibility: proximity to the Tube and bus stops

- The presence of parks, shops, cafés, and public spaces

- Educational accessibility: homes near schools, universities, and colleges

- Amenities: dog walking areas, bicycle storage, greener or safer neighbourhoods

For each London area, we have prepared detailed guides outlining all the location's strengths and weaknesses.

Neighbourhood Safety

We will yield information about the safest neighbourhoods, ensuring your peace of mind.

Let 1newhomes be your guiding light, leading you to the perfect choice, thoughtfully crafted with first-time buyers in mind.

Flat Pricing

We understand the significance of price per square meter. In our London new homes' database, we've gathered the best options at the most affordable prices.

You can use a mortgage calculator to calculate the cost of a mortgage flat.

For Every Member of Your Family

We also understand that decisions regarding flat purchases are family discussions. We offer opportunities for joint viewings and consultations to meet all your family's needs.

Support and Assistance in Flat Selection

Our experts are always ready to answer your questions and guide you through every step.

Don't hesitate to make informed decisions - we are here to help you find the perfect home that suits your needs.

Fill out a consultation request now, and we'll assist you in finding the home that's just right for you.

What are you looking for?

Step 1 of 4

ready to help you

What are you looking for?

Frequently Asked Questions

FAQ

To buy your first home in London, begin by assessing your finances. Research different neighbourhoods, hire a reputable real estate agent, and attend property viewings to find a suitable home within your financial means.

Once you identify a property, make an offer through your agent, and engage a solicitor or conveyancer for the legal process, including property searches and contract handling.

Navigating the London property market requires patience and diligence. Be thorough in your research and consult our First Homes Scheme to make the best choices for your first home in London.

To buy a house in London, a common guideline suggests that your mortgage payments should not exceed 28-31% of your gross monthly income.

However, given the high property prices in London, a substantial salary is often required. It's advisable to use online mortgage calculators and consult with a financial advisor to determine a realistic budget. It might be based on your specific circumstances, considering factors such as down payment, interest rates, and additional costs like stamp duty and legal fees.

The decision of whether to purchase a home now hinges on various factors.

If you come across an affordable property and intend to stay for the long term, it could be an opportune moment to buy, particularly considering the declining mortgage rates.

The latest data indicates a deceleration in house price growth. In October 2023, house prices registered a decrease of -1.1% compared to the previous year, with the average cost of a UK house now standing at £291,000.

The typical price for a first-time buyer property in London is approximately £425,000, accompanied by an average deposit of £144,500.

In relation to the property price, first-time buyers, on average, contributed a deposit equivalent to 33.99%.

Nevertheless, the required savings amount varies based on your location within London and, naturally, the desired deposit percentage you aim to provide. As per UK Finance, the majority of first-time buyers aim to contribute a larger deposit for their initial home purchase, typically accounting for 24% of the total property price.

Selection of new buildings for First-time buyers

All new homes →