Remarkable Expansion in the Bridging Sector Despite Difficult Market Conditions

The bridging sector has witnessed remarkable growth, surging by 67.6% (to £278.8 million) in the first quarter of 2023, primarily due to challenging industry conditions. Swing loans come into play when property transactions extend over time, raising the risk of a fall-through or chain break.

Continued upward trend is foreseen in activity throughout 2024, projecting it to reach £281.2 million per quarter as these adverse conditions may persist. It is noted that the surge in bridging industry activity during the pandemic was driven by increased volume rather than market volatility.

Nevertheless, he predicts that the reliance on swing finance will become even more significant as the year unfolds.

Since the market started cooling in Q3 of the previous year, swing lending has grown by 21.7% per quarter.

"However, in current cooling market conditions, the reliance on bridging is arguably greater due to the higher propensity for sales to drag on for some months, increasing the probability of a fall through and chain break."

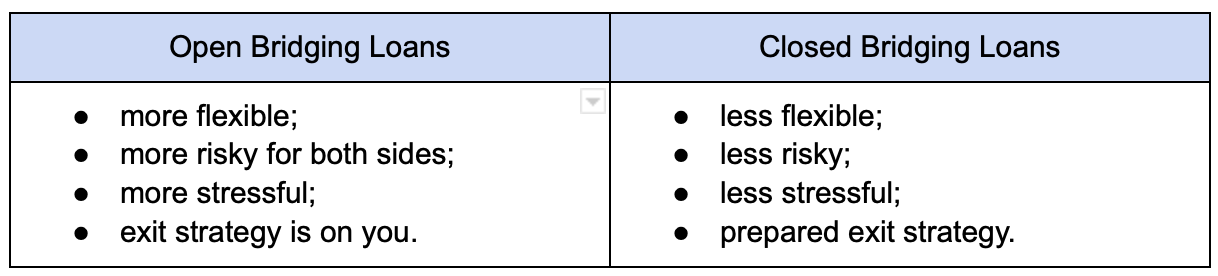

Both open and closed bridging financings serve as short-term solutions. Open credits provide greater flexibility. It makes them appealing to property sellers with interest but no concrete offers and developers with scheduled works but uncertain timings.

However, lacking a clear demise strategy can lead to longer-than-expected timescales, leading to increased costs with lenders offering extended agreements and accumulating monthly arrear charges.

It poses elevated risks for both borrowers and lenders. Consequently, lenders should carefully assess their financial tolerances when deciding between two types of pledges.

Closed swing loans with a well-established exit strategy provide an additional layer of security. Therefore, they offer more favourable rates compared to open allowances.

Given the reduced risk, lenders are likely to prefer closed loans and are more inclined to approve applicants seeking them. Moreover, the closed credit process is less stressful for borrowers as having a pre-established exit plan minimizes concerns about loan repayment and the possibility of plans falling through.

Although closed allowances may offer less flexibility than open deals, borrowers still have several options. One common bridging pledge exodus scenario involves the sale of the primary real estate, assessed based on various variables (e.g. refurbishment plans' timing, demand in the broader market).