Buyers' Interests Shift Towards New Flats In 2023

There is a clear trend of shifting buyers' priorities towards affordable new apartments instead of spacious houses in early 2023.

We gathered the latest market insights in the UK property market and found several curious trends that are dominating the markets, including new homes in London, so far in 2023. What are the key findings?

Central Trends

- There is a rapid shift of interest towards new flats and apartments at affordable prices amid the costs of living crisis.

- Small suburban towns are proving to be the most desired locations.

- This year kicked off to a slow start but is set to gather momentum by April as more transactions take place.

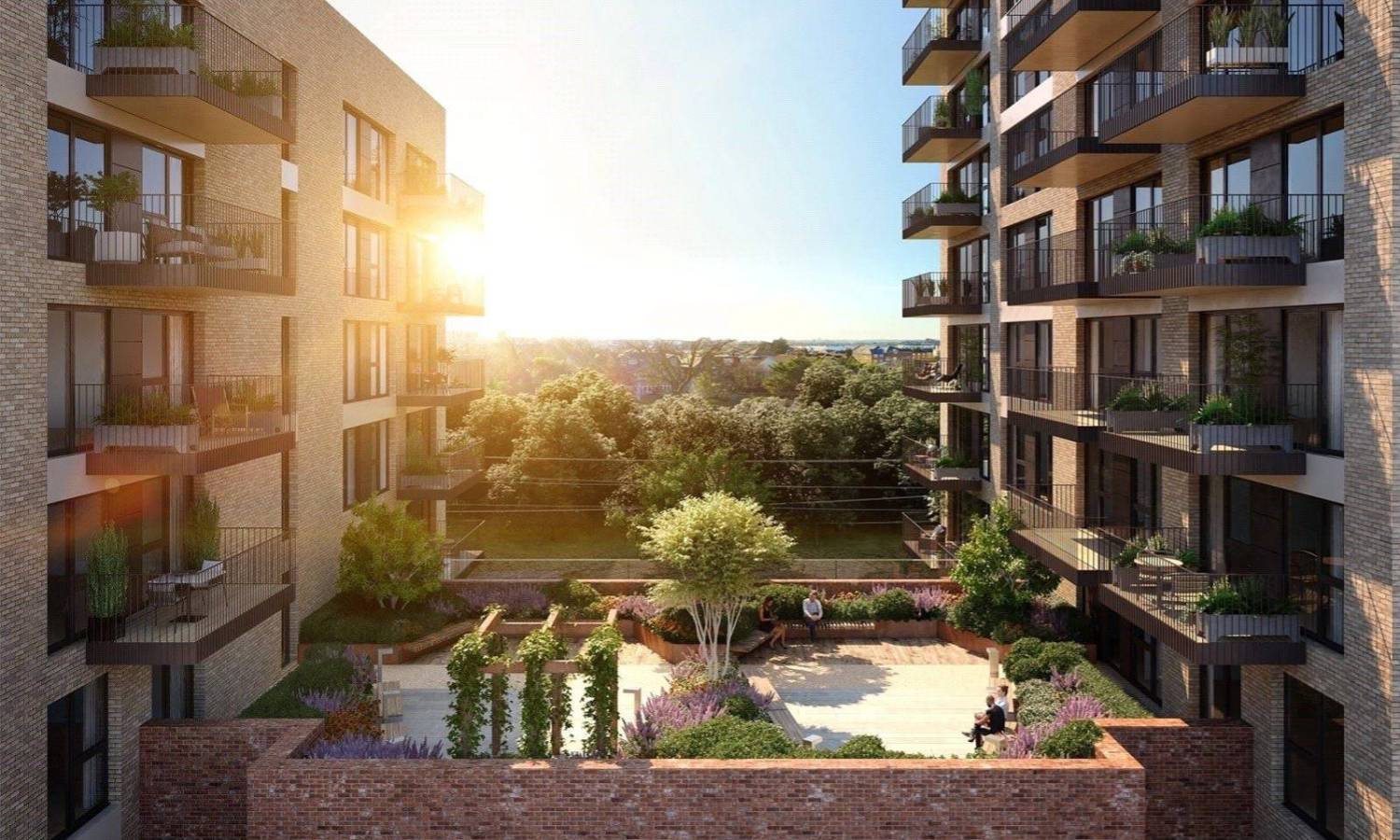

New Apartments Regain Appeal

The first months of 2023 revealed that current buyers are very cautious about home values, and many prefer affordable new flats and apartments to spacious houses. Rising base rates, living costs crisis, and inflation affected the affordability and our budgets, so this trend is justified.

Currently, the appeal of new apartments is on the rise, while there is a notable decline in demand for 3-bedroom houses, the most popular property type in the UK.

As for the stats, 27% of current buyers are searching for new flats, up by 5% year-on-year (YoY). Moreover, almost half of all property buyers in the capital are looking for 1- and 2-bed apartments in London, up by 8% YoY. In turn, demand for 3-bedroom houses has fallen by 5%, suggesting that buyers' priorities are changing.

Property Hotspots In 2023

New builds in London continue to sustain its appeal for local and international buyers. However, many suburban houses near the capital and other big cities also gain popularity among property hunters.

For instance, Slough, Watford, and Chelmsford have seen some of the most significant spikes in demand for flats so far in 2023, creating new opportunities for the market.

Generally, 2023 is off to a slower start compared to 2022 and 2021. The recent economic changes and volatility directly impact affordability, so this trend is hardly unexpected.

However, many anticipate demand to gather momentum in the coming months as mortgage rates continue to fall and house prices adjust to the new settings.